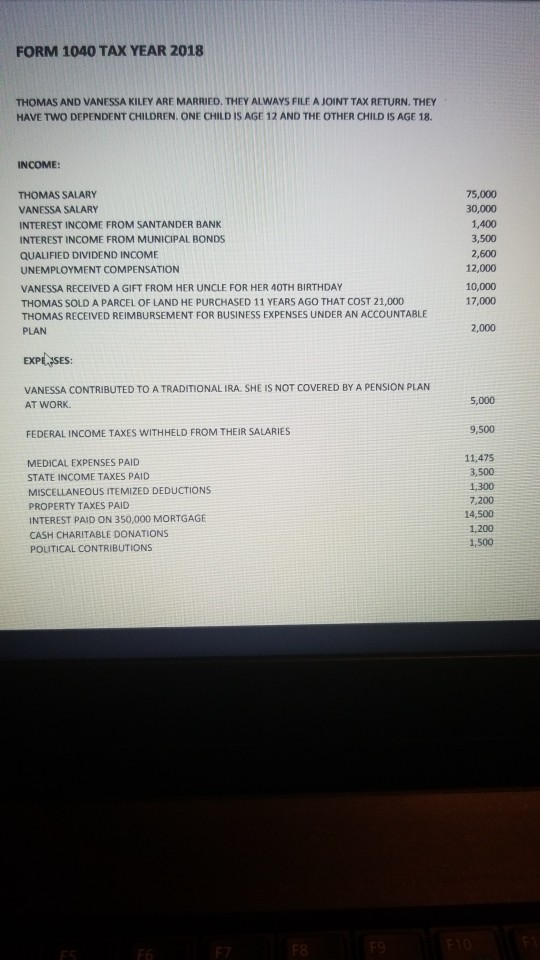

Question: FORM 1040 TAX YEAR 2018 THOMAS AND VANESSA KILEY ARE MARRIED. THEY ALWAYS FILE A JOINT TAX RETURN…

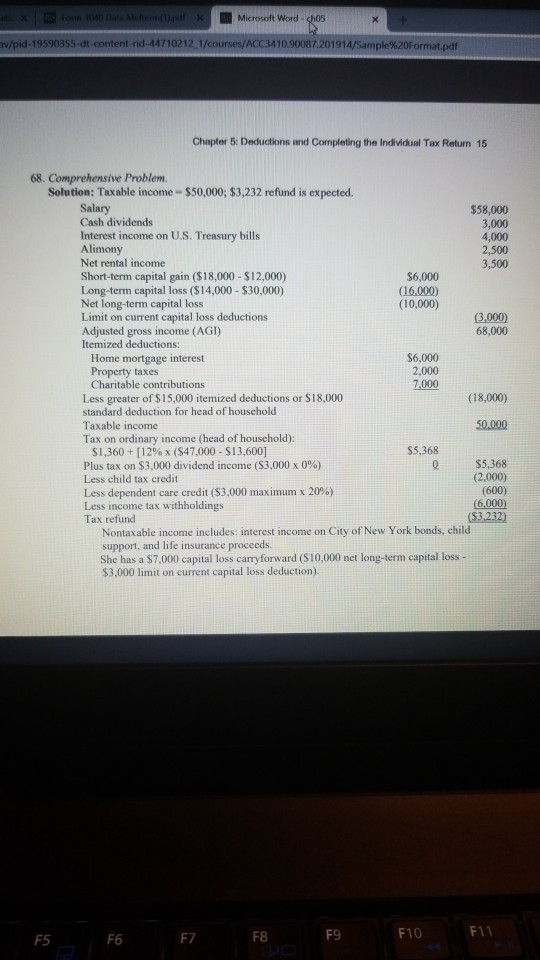

please answer in the same format as second picture

(sample format)

Show transcribed image text FORM 1040 TAX YEAR 2018 THOMAS AND VANESSA KILEY ARE MARRIED. THEY ALWAYS FILE A JOINT TAX RETURN. THEY HAVETWO DEPENDENT CHILDREN, ONE CHILD IS AGE 12 AND THE OTHER CHILD IS AGE 18 INCOME THOMAS SALARY VANESSA SALARY INTEREST INCOME FROM SANTANDER BANK INTEREST INCOME FROM MUNICIPAL BONDS QUALIFIED DIVIDEND INCOME UNEMPLOYMENT COMPENSATION VANESSA RECEIVED A GIFT FROM HER UNCLE FOR HER 40TH BIRTHDAY THOMAS SOLD A PARCEL OF LAND HE PURCHASED 11 YEARS AGO THAT COST 21,000 THOMAS RECEIVED REIMBURSEMENT FOR BUSINESS EXPENSES UNDER AN ACCOUNTABLE PLAN 75,000 30,000 1,400 3,500 2,600 12,000 10,000 17,000 2,000 EXPEJSES: VANESSA CONTRIBUTED TO A TRADITIONAL IRA SHE IS NOT COVERED BY A PENSION PLAN AT WORK. 5,000 9,500 FEDERAL INCOME TAXES WITHHELD FROM THEIR SALARIES MEDICAL EXPENSES PAILD STATE INCOME TAXES PAID MISCELLANEOUS ITEMIZED DEDUCTIONS PROPERTY TAXES PAID INTEREST PAID ON 350,000 MORTGAGE CASH CHARITABLE DONATIONS POLITICAL CONTRIBUTIONS 11,475 3,500 1,300 7,200 14,500 1,200 1,500

FORM 1040 TAX YEAR 2018 THOMAS AND VANESSA KILEY ARE MARRIED. THEY ALWAYS FILE A JOINT TAX RETURN. THEY HAVETWO DEPENDENT CHILDREN, ONE CHILD IS AGE 12 AND THE OTHER CHILD IS AGE 18 INCOME THOMAS SALARY VANESSA SALARY INTEREST INCOME FROM SANTANDER BANK INTEREST INCOME FROM MUNICIPAL BONDS QUALIFIED DIVIDEND INCOME UNEMPLOYMENT COMPENSATION VANESSA RECEIVED A GIFT FROM HER UNCLE FOR HER 40TH BIRTHDAY THOMAS SOLD A PARCEL OF LAND HE PURCHASED 11 YEARS AGO THAT COST 21,000 THOMAS RECEIVED REIMBURSEMENT FOR BUSINESS EXPENSES UNDER AN ACCOUNTABLE PLAN 75,000 30,000 1,400 3,500 2,600 12,000 10,000 17,000 2,000 EXPEJSES: VANESSA CONTRIBUTED TO A TRADITIONAL IRA SHE IS NOT COVERED BY A PENSION PLAN AT WORK. 5,000 9,500 FEDERAL INCOME TAXES WITHHELD FROM THEIR SALARIES MEDICAL EXPENSES PAILD STATE INCOME TAXES PAID MISCELLANEOUS ITEMIZED DEDUCTIONS PROPERTY TAXES PAID INTEREST PAID ON 350,000 MORTGAGE CASH CHARITABLE DONATIONS POLITICAL CONTRIBUTIONS 11,475 3,500 1,300 7,200 14,500 1,200 1,500